Bryan Taylor, Chief Economist, Finaeon

Yes, Virginia, you can buy shares in central banks. Today, you can buy shares in five central banks in Belgium, Greece, Japan, South Africa, Turkey and Switzerland. Until the 1940s, most central banks were publicly traded and you could invest in central banks in over a thirty different countries. When most of these banks were founded, they were not central banks in the modern sense of the word. A central bank is a bank for other banks. Central banks were established by the government to issue banknotes, to act as a bank for the government’s funds, to be a bank for other banks, and to discount and provide loans to domestic companies. Multiple banks were sometimes allowed to issue banknotes, but eventually the national bank established a monopoly on note issue. So bank note issue is not a defining criterion of being a central bank. Instead, it is being a bank to other banks, being a lender of last resort, and taking on the responsibility for the stability of the country’s financial system.

The central bank can change the discount rate, or lending rate, to influence the nation’s economy and encourage or discourage capital from flowing into and out of the country. In the beginning, the national bank was usually the only bank in the country. Over time, the government allowed more banks to be established and the national bank’s role in lending to the private sector shrank became more limited. The national bank slowly became only a bank to other banks and finally a central bank whose primary responsibility was maintaining the stability of the national economy. Many central banks were nationalized after World War II and although the central banks are independent of the government today, they either are owned by the government or are restricted by the government in what the bank can do. Even for publicly traded banks, you cannot make a hostile takeover of a central bank. The national government already controls them.

Between the founding of each central bank and their nationalization, anyone could buy shares in the bank. Since the national bank was the bank to the government, it had a degree of safety that other banks did not have. The government simply could not allow the central bank to go bankrupt. In this sense, the central bank was as safe as government bonds. However, because the central bank was a private entity, it was supposed to provide profits to its shareholders. Profits should rise over time. Although most central banks provided excess profits to the government, they could increase their dividend. In this sense, the central bank was more like a utility that was regulated by the government than a private corporation and was too important to fail.

Although you could buy shares in a central bank, you could not buy up all the shares and own the central bank. The government had the right to choose the people who ran the central bank, impose regulations on its behavior, and ultimately, to take over the running of the central bank. As a shareholder you could receive dividends and profit from any change in the price of the central bank, but that was all.

So were investors wise to invest in central banks, either today or in the past? Did the returns exceed those on government bonds? How did returns compare to the stock market as a whole? Just based upon risk, national banks should have outperformed government bonds, but underperformed the stock market as a whole. In the beginning, the central bank was sometimes the entire stock market, but by the 1830s and 1840s, railroads began to dominate the stock market in each country and governments allowed other banks to come into existence. Central banks’ importance in the stock market slowly shrank.

The Role of Central Banks

One of the principal duties of central banks is to print currency for the country. Normally, the central bank, or the government itself, is the only printer of currency. In some countries, multiple banks were allowed to issue currency. This was especially true in Anglo countries and colonies, such as Scotland, Ireland, Canada, South Africa, or Hong Kong, as well as many Latin American countries. Today, only in a few countries are there multiple currency issuers: Hong Kong, Northern Ireland and Scotland are examples.

What makes a central bank a central bank? Generally, the central bank is a bank to other banks and is responsible for overseeing the financial side of the economy. In the past, the central bank was responsible for printing currency, controlling the money supply, promoting a stable economy and financial system, keeping inflation to a minimum, maintaining the value of the currency, acting as a fiscal agent for the government, providing loans to other banks by discounting paper, and acting as a lender of last resort. In the past, many central banks were also commercial banks that made loans to corporations, but today such loans are generally limited to commercial banks.

Table 1 provides a list of central banks for 30 different central banks providing information on when each bank was founded and when each bank was nationalized by the government. Central banks for which there is no information on the date of nationalization are publicly traded. The Danmarks Nationalbank and Banca d’Italia were the first central banks to be nationalized in 1936. Since then, more central banks have been nationalized in each decade.

| Bank | Country | Founded | Nationalized |

| Bank of Albania | Albania | 1925 | 1945 |

| National Bank of Angola | Angola | 1926 | 1975 |

| Central Bank of Argentina | Argentina | 1935 | 1946 |

| Oesterreichische Nationalbank | Austria | 1816 | 2010 |

| Banque Nationale de Belgique | Belgium | 1850 | 1948 |

| Bank of Canada | Canada | 1935 | 1938 |

| El Banco de la Republica | Colombia | 1923 | 1973 |

| Danmarks Nationalbank | Denmark | 1818 | 1936 |

| Central Reserve bank of El Salvador | El Salvador | 1934 | 1961 |

| Bank of England | England | 1694 | 1946 |

| Bank of Estonia | Estonia | 1919 | 1940 |

| Banque de France | France | 1800 | 1946 |

| Prussian National Bank | Germany | 1847 | 1875 |

| Reichsbank | Germany | 1876 | 1945 |

| Bank of Greece | Greece | 1928 | |

| Bank of the Republic of Haiti | Haiti | 1874 | 1979 |

| Reserve Bank of India | India | 1935 | 1949 |

| Javasche Bank | Indonesia | 1827 | 1951 |

| Banca d'Italia | Italy | 1893 | 1936 |

| Bank of Japan | Japan | 1882 | |

| Banco de Mexico | Mexico | 1925 | 1982 |

| Nederlandsche Bank | Netherlands | 1814 | 1953 |

| Reserve Bank of New Zealand | New Zealand | 1934 | 1935 |

| State bank of Pakistan | Pakistan | 1948 | 1974 |

| Bank of Portugal | Portugal | 1846 | 1974 |

| National Bank of Romania | Romania | 1880 | 1946 |

| South African National Bank | South Africa | 1920 | |

| Banco de Espana | Spain | 1782 | 1962 |

| Sveriges Riksbank | Sweden | 1868 | 1992 |

| Swiss National Bank | Switzerland | 1907 |

Table 1. Founding and Nationalization Dates for Central Banks

Central Banks That Are Publicly Traded Today

There are several central banks that are publicly traded today. These include the Swiss National Bank, the Bank of Japan, the South African Reserve Bank, the Bank of Greece, and the National Bank of Belgium. However, don’t plan on making a hostile takeover of any of these banks or making a fortune off your investment. In each country, the government restricts ownership of shares and limits the dividend that can be paid on each stock.

The dividends for Japan, Switzerland and South Africa are limited by their par capital. Switzerland’s dividend is fixed at 15 CHF per annum (the stock is around 5,000 CHF), Japan at 5 Yen (about 5 cents) and South Africa at 0.10 Rand (about 0.5 cents). Only Belgium and Greece can change their dividend each year. The National Bank of Belgium cut its dividend to 1 Euro from 93 Euros in 2023, reducing the dividend to 0.2%. Before 2023, Belgium paid a fixed 6% dividend and then paid additional dividends on top of that based upon profitability, but rising interest rates caused the National Bank of Belgium to lose money in 2023 for the first time in 70 years. They chose to slash their dividend, driving the stock price down. Consequently, only the Bank of Greece pays a decent dividend of 4%, though the stock has fallen from 92 in 2006 to 16 today. The South African Reserve Bank stock is fairly illiquid and has a small float. No shareholder is allowed to hold more than 10,000 of the 2 million outstanding shares. Shares of the Bank of Greece, National Bank of Belgium and Bank of Japan have all declined in price over the past 35 years. Only the Schweizerisches National Bank stock has performed well, primarily because it has invested its assets wisely in stocks that appreciated in value.

Let’s look at each of the central banks that is publicly traded and see how they have done.

Belgium

Founded: 1850

Nationalized: March 4, 1948 semi-nationalized, government takes a 50% stake

Annual Return from 1850 to 2022: (Bank 5.82%, Stocks 6.97%, 3.95% Bonds)

Shares Outstanding: 05/05/1850 (25,000 shares), 1872 (50,000 shares), 1927 (200,000 shares)

Market Capitalization: 1850 ($6 million), 1886 ($28.53 million), 1900 ($31.05 million), 1925 ($11.98 million), 1950 ($26.40 million), 1975 ($216.22 million), 2000 ($533.3 million), 2010 ($2,366 million), 2022 ($292 million)

Belgium gained its independence from the Netherlands in 1831. The Société Générale de Belgique was established in 1822 and was allowed to issue banknotes. The banking crisis following the Revolution in Paris in 1848 led to the suspension of the convertibility of banknotes in both France and Belgium. The Belgian banking system was reformed in 1850 and the Banque Nationale de Belgique was established to have a monopoly on the issue of banknotes in Belgium. The bank could also discount short-term bills and acted as the fiscal agent for the Treasury. The bank was required to keep a metal reserve equal to one-third of its note issue and acted as a lender of last resort.

Belgium joined the Latin Monetary Union in 1865 along with France, Italy and Switzerland, and silver coins became legal tender. During the German occupation during World War I, the German authorities withdrew the right of note issue and granted this right to the Société Générale de Belgique. After the war, the right to issue banknotes was returned to the Banque Nationale. The Banque Nationale was semi-nationalized on March 4, 1948 with the government taking control of 50% of the shares. The bank remains a publicly traded company, and it is a member of the European System of Central Banks.

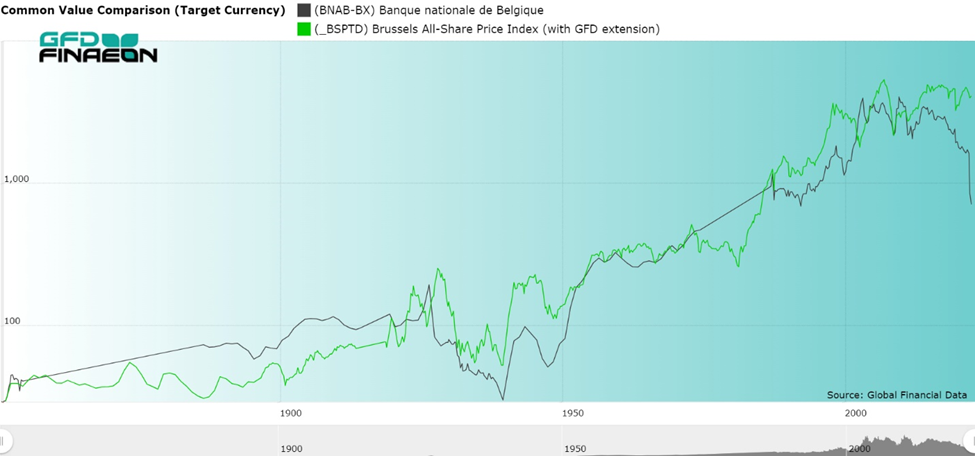

Until recently, shares of the Banque Nationale de Belgique behaved similarly to the Belgian stock market as is illustrated in Figure 1; however, the price of Belgian National Bank shares plunged during the past two years as rising interest rates caused the bank to lose money for the first time in 70 years. This forced the bank to lower its dividend from €96.63 to €1.05. The stock has returned to the level it was at in 1975.

Figure 1. Banque Nationale de Belgique and the Belgium Price Index, 1850 to 2023

Greece

Founded: 1928

Annual Return from 1993 to 2022: (Bank 9.71%, Stocks 3.09%, Bonds -14.14%)

Shares Outstanding: 1993 (19,864,886 shares)

Market Capitalization: 1993 ($89 million), 2007 ($2,132 million), 2022 ($356 million)

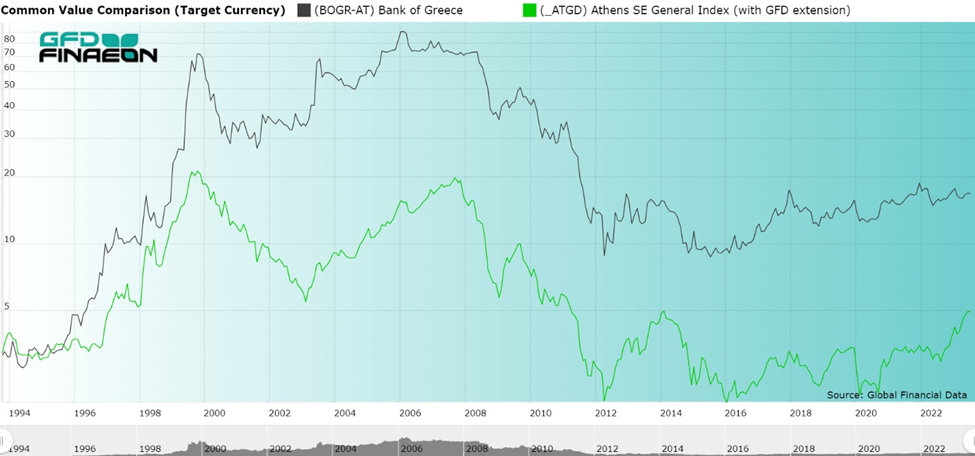

An investment in the Bank of Greece would have lost money during the past 15 years. If Bank of Greece stock outperformed the Greek stock market in general, it is only because the Greek stock market has done so poorly since 2000. The Greek stock market and Bank of Greece stock did very well as Greece qualified to join the Euro in 2001. Greece suffered high inflation during the twentieth century, and it was thought that the Euro would provide Greece the stability it needed to develop in the twenty-first century. The Greek economy did well in the last two decades of the twentieth century, and it was thought this would continue in the twenty-first century. The stock market declined after Greece joined the Euro, recovered into 2008, then declined dramatically, losing 80% of its value after 2008. As the Euro crisis grew worse, both the dividend and Bank of Greece stock declined in value. Greece defaulted in 2012 and banks were closed in 2015 when Greece threatened to leave the Euro. Since 2015 the banking system has shown a modest recovery. Because of the default, investors lost money on Greek bonds. Greece may pay the highest dividend of any of the five central banks, but its fundamentals are still shaky. Bank of Greece stock hasn’t budged since 2012. The central bank is only as sound as the country it is in.

Figure 2. Bank of Greece stock and the Athens SE General Index, 1993-2023

Japan

Founded: 1882

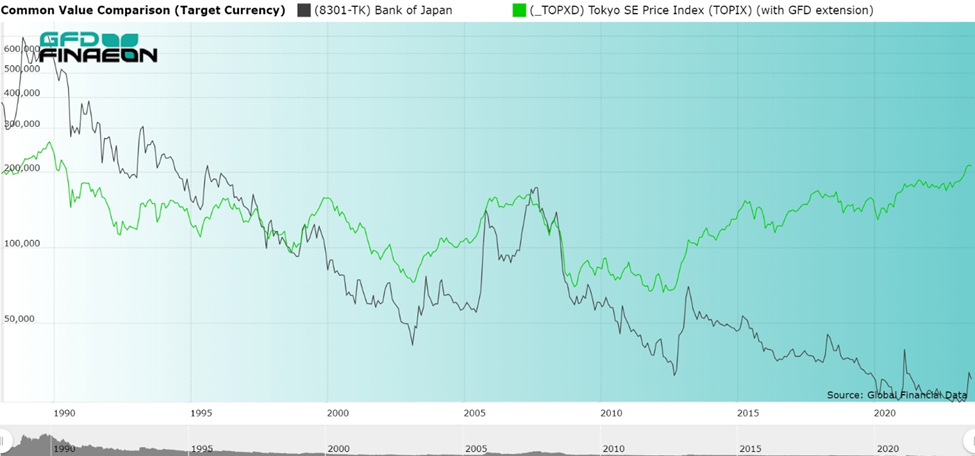

Annual Return from 1988 to 2022: (Bank -8.84%, Stocks -0.52%, Bonds 2.97%)

Shares Outstanding: 1980 (1 million shares)

Market Capitalization: 1988 ($5,603 million), 2000 ($568 million), 2022 ($185 million)

Investors in Bank of Japan stock have done poorly since the Japanese stock market bubble popped in 1989. However, investors holding Bank of Japan stock have done even worse than Japanese equity investors in general as Figure 3 shows. The price of Bank of Japan stock has declined from 700,000 Yen at the end of 1988 to 24,300 Yen at the end of 2022, a decline of over 96%. The annual dividend of 5 Yen (about 5 cents) provides little compensation and investors receive the lowest dividend of any central bank. Most of the profits of the Bank of Japan go to the government. The Bank of Japan currently owns the majority of Japanese government debt. While the Japanese stock market hit bottom in 2012 and has risen during the past ten years, Bank of Japan shares have continued to decline. Despite their low yields, Japanese government bonds have outperformed both stocks and Bank of Japan stock during the past 35 years. The federal government owns 55% of the bank’s shares. Shareholders have no right to select BOJ officials and in the case of the dissolution of the bank, shareholders would only receive about 100 Yen per share. Bank of Japan shares have been and continue to be a very poor investment.

Figure 3. Bank of Japan and Tokyo SE Price Index, 1988 to 2023

Switzerland

Founded: 1907

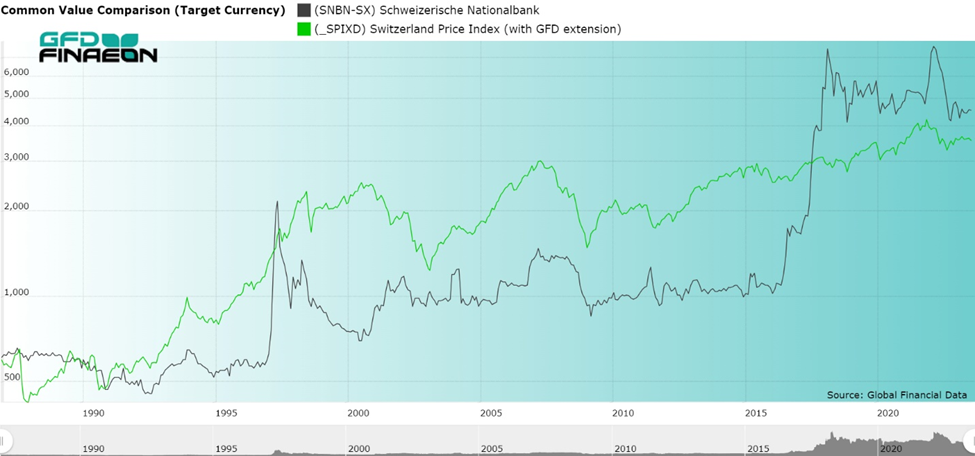

Annual Return from 1987 to 2022: (Bank 8.10%, Stocks 8.84%, Bonds 2.93%)

Shares Outstanding: 1980 (100,000 shares)

Market Capitalization: 1986 ($38 million), 2000 ($475 million), 2022 ($5,182 million)

The Swiss were given the opportunity to have a government-owned central bank in 1897, but the central bank was rejected in a referendum. Instead, a privately owned central bank was founded in 1907. One-fifth of the bank was owned by other banks as compensation for giving up the right to issue currency. Private shareholders own about 37% of the bank, cantonal governments about 40% and cantonal banks 12%. Shares of the Swiss National Bank have done as well during the past 35 years as Bank of Japan stock has done poorly, as is illustrated in Figure 4.

Although Swiss National Bank stock has underperformed the Swiss Stock Market, it has still provided a high rate of return of over 8%. There was a price spike in 1997 due to speculation concerning the bank’s plans to mark to market the bank’s gold holdings. Another price spike occurred in 2017 when the Swiss National Bank bought foreign currencies to control the appreciation of the Swiss Franc and then invested these assets in an equity portfolio which included Facebook, Apple and other companies. The stock has remained at its inflated level as a result. The bank’s dividend has been fixed at 15 Francs per share since 1921 which is now less than 1%, so the return comes almost exclusively through capital appreciation. Two-thirds of the bank’s profits go to the cantonal governments and one-third to the federal government. Although shareholders can choose five of the members of the Swiss National Bank’s board, the government chooses six of them. Shareholders have little power in the bank, and most of the increase in share price has been due to two price spikes in 1997 and 2017. With such a small dividend, you certainly can’t rely upon the stock for income.

Figure 4. Swiss National Bank shares and the Switzerland Price Index, 1987 to 2023

All of this shows that of the five banks that are publicly traded today, none of them behave like “normal” investments. Although you can buy shares in each central bank, you could never own the central bank or influence its decisions. You are at the mercy of the government and if things go wrong, as they have in Belgium, Greece and Japan, shareholders pay the price. The strong performance of Swiss National Bank shares seems to be an anomaly. But were things always this bad? Certainly, shareholders never had a controlling interest in any central bank, but let’s review the behavior of banks that are no longer traded.

Central Banks that Were Publicly Traded in the Past

If central banks do not provide an attractive investment today, did they in the past? We have data on the behavior of central banks and national banks in ten countries: Austria, Canada, Denmark, England, France, Germany, Indonesia, the Netherlands, Spain, and the United States. We provide information on the performance of each of these banks below along with a brief history of each national bank before it became a central bank.

| Country | Start | End | Bank | Bonds | Stocks |

| Austria | 1817 | 1936 | 12.51 | 10.88 | 12.17 |

| Belgium | 1851 | 2022 | 5.82 | 3.95 | 6.97 |

| Canada | 1935 | 1938 | 5.08 | 4.91 | 8.2 |

| Denmark | 1837 | 1935 | 6.25 | 4.59 | 6.59 |

| England | 1694 | 1946 | 5.26 | 3.97 | 5.79 |

| France | 1801 | 1945 | 6.58 | 5.28 | 6.84 |

| Germany | 1847 | 1875 | 8.5 | 4.64 | 4.16 |

| Germany | 1876 | 1945 | 44.44 | 44.61 | 44.92 |

| Indonesia | 1877 | 1950 | 5.187 | 3.844 | 5.028 |

| Netherlands | 1816 | 1942 | 6.38 | 4.66 | 6.16 |

| Spain | 1854 | 1960 | 8.17 | 5.74 | 5.77 |

| United States | 1791 | 1812 | 4.68 | 5.87 | 5.2 |

| United States | 1816 | 1837 | 1.94 | 5.55 | 5.02 |

Table 2. Returns to Banks, Bonds and Stocks for 13 Central and National Banks

Austria

Founded: 1816

Nationalized: 1938

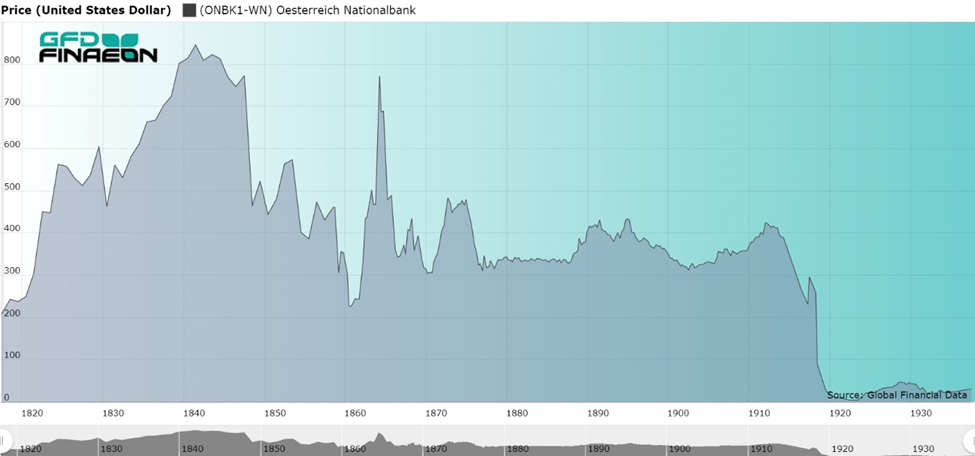

Annual Return from 1816 to 1937 (Bank, 12.51%, Stocks 12.17%, Bonds 10.88%)

Shares Outstanding: 1817 (50,000), 1855 (100,000), 1868 (150,000), 1922 (300,000)

Market Cap: 1817 ($10.5 million), 1825 ($27.97 million), 1850 ($22.28 million), 1860 ($22.86), 1875 ($58.10 million), 1900 ($51.31 million), 1925 ($6.77 million), 1938 ($9.46 million)

The Priviligierte Oesterreichische National Bank (Chartered Austrian National Bank) was founded in 1816 as a joint-stock bank modeled on the Banque de France. It succeeded the municipality-owned Wiener Stadtbank and had the goal of replacing the depreciated currency of the Wiener Stadtbank with currency issued by the Nationalbank. The Nationalbank was authorized to accept deposits and discount bills and given the exclusive right to issue notes convertible into silver. The bank’s charter was renewed in 1842. It continued to have a monopoly over note issue but lost the exclusive privilege to discount paper and make mortgage loans. Convertibility of banknotes was suspended in 1848, restored in 1858, suspended again in 1859 and restored under a gold standard in 1891 when the Krone replaced the Gulden. The bank was renamed the Austro-Hungarian Bank in 1878. The Austrian National Bank replaced the Austro-Hungarian Bank in 1922 after the Austro-Hungarian Empire was broken up following World War II, and the Gold Kronen replaced the paper Kronen at the rate of 10,000 to 1. Separate central banks were established in Hungary and Czechoslovakia. After the Anschluss in 1938, the Austrian National Bank was liquidated and absorbed by the Reichsbank, and all of its gold reserves were transferred to Germany. Except as a branch of the Reichsbank, the Austrian National Bank ceased to exist until the war ended and the bank was reestablished in July 1945. The Oesterreichische National Bank was re-established in 1948 and the maintenance of the internal and external value of the currency became its primary goal.

The Oesterreichisches Nationalbank was the first security to trade on both the Vienna and the Frankfurt Stock Exchanges. The stock, along with Austrian government bonds, were widely quoted in Europe in the 1800s. The performance of the Oesterreisches Nationalbank and the index for the Austrian stock market are compared in Figure 5. The National Bank underperformed the rest of the stock market between 1850 and 1914 when the Austrian stock market was closed because of World War I. The Bank oversaw both the 1873 stock market collapse and more importantly, the collapse of the Creditanstalt Bank in 1931 which brought the Great Depression to central Europe.

Figure 5. Oesterreisches Nationalbank and WBKI, 1817 to 1937

During the 120 years when the National Bank was in existence, it outperformed the Austrian stock market on a total return basis and outperformed government bonds as well. The bank returned 12.51% per annum, stocks 12.17% and bonds 10.88%. Because of the hyperinflation that occurred in Austria after World War II, it is hard to accurately judge the returns. If you convert the shares into US Dollars, you can see that shares depreciated severely after World War I. The Austrian National Bank only served Austria and not the Austro-Hungarian Empire, so its capitalization was only about 20% of the Austro-Hungarian Bank’s capitalization.

Figure 6. Oesterreichisches Nationalbank in US Dollars, 1817 to 1937

Canada

Founded: 1934

Nationalized: 1938

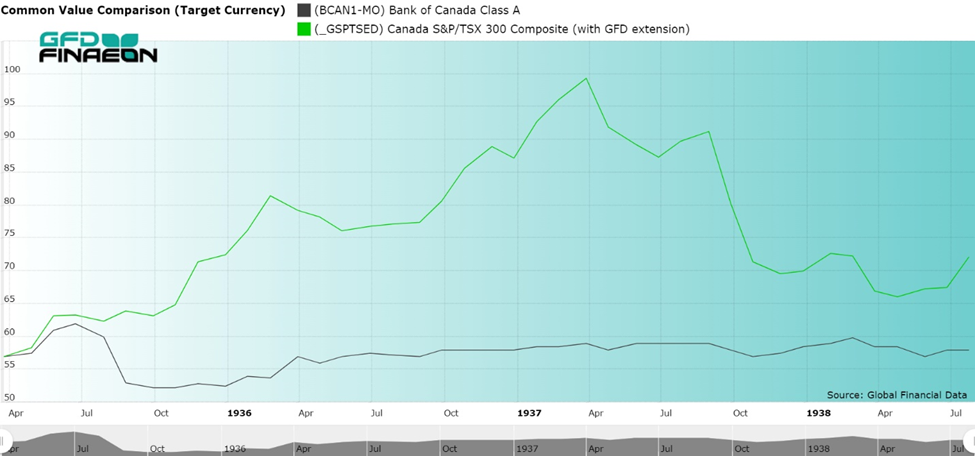

Annual Return from 1935 to 1938: (Bank 5.08%, Stocks 8.20%, Bonds 4.91%), Dividend Yield 3.75%

Shares Outstanding: 100,000

Market Capitalization: $6 million

During the 1800s, the federal government had a monopoly on the issue of small denomination notes (below $5) and banks issued higher denomination notes up to the amount of their paid-up capital. The Bank of Montreal, founded in 1817, acted as the government’s bank until the 1930s. During banking crises, such as 1907 and 1914, the government acted as a lender of last resort, making advances to banks against collateral.

Proposals for a central bank were made beginning in 1913. In 1933, Prime Minister Bennett asked Lord MacMillan to conduct a Commission of Inquiry into banking in Canada with the goal of establishing a central bank in Canada. The Bank of Canada Act of 1934 gave the bank a monopoly over note issue and required the bank to hold gold reserves equal to 25% of its banknote issue. The Bank was also directed to act as the fiscal agent of the government, to discount and make advances against tradable securities and to deal in securities, foreign currencies, and bullion. The Bank had the duty of regulating currency and credit, protecting the external value of the national monetary unit and to promote the economic and financial welfare of the Dominion.

The bank was organized as a privately owned institution. In 1936, additional shares were issued to give the government 51% control over the bank, and in 1938, the Bank of Canada was completely nationalized with the government taking control of 100% of the outstanding shares. Consequently, only three years of data on the shares of the Bank of Canada, from 1935 to 1938, exist.

Figure 7. Bank of Canada and Canada Price Composite, 1935 to 1938

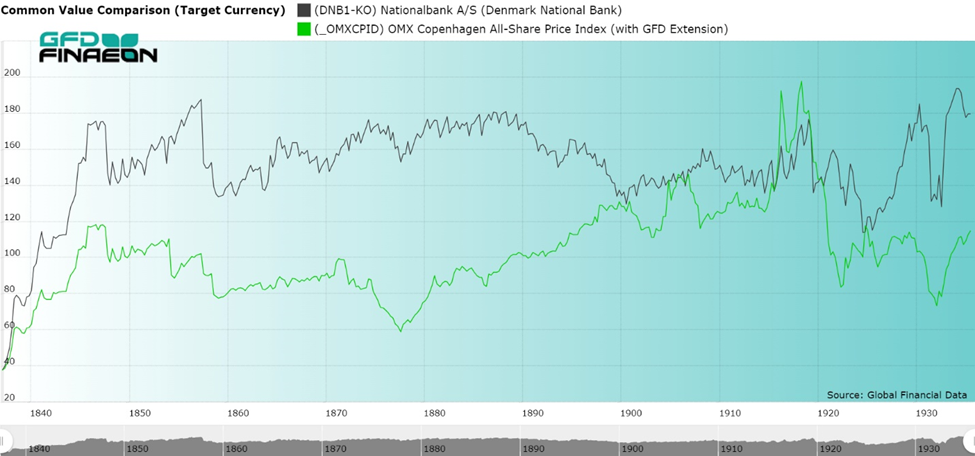

Denmark

Founded: 1818

Nationalized: 05/01/1936

Annual Return from 1837 to 1935: (Bank 6.25%, Stocks 6.59%, Bonds 4.59%)

Shares Outstanding: (270,000 shares)

Market Capitalization: 1837 ($2.99 million), 1850 ($10.93 million), 1860 ($9.59 million), 1870 ($12.27), 1880 ($12.37 million), 1890 ($12.14 million), 1900 ($9.66 million), 1910 ($10.27 million), 1920 ($5.84 million), 1935 ($10.68 million)

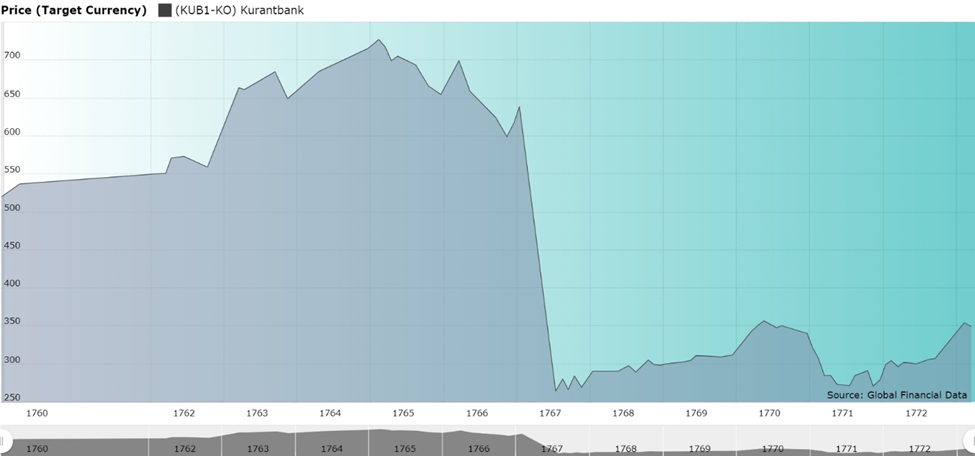

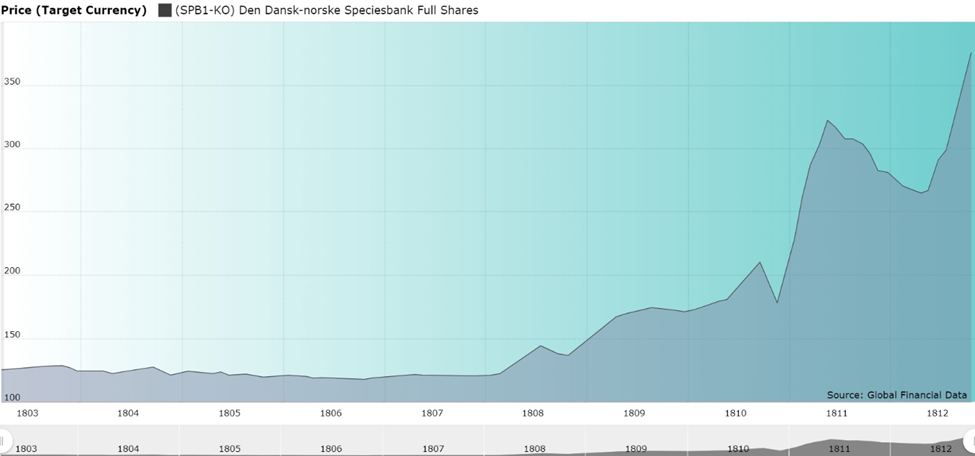

Before the Danmarks Nationalbank was founded in 1818, Denmark had had two national banks that had a monopoly right to issue currency and financed government expenditures. These were the Kurantbanken (Currency Bank) and the Dansk-norske Speciesbank.

Figure 8. Kurantbanken, 1759 to 1773

The Kurantbanken was established in 1736; however, because of an overissue of banknotes, the banknotes could no longer be converted into silver. The bank was nationalized in March 1773 and shareholders received bonds in place of their shares.

Figure 9. Dansk-norske Speciesbank, 1803-1812

The Specie Bank was established in 1791, but it suffered the same fate as the Kurantbanken because it also funded government expenditures to help the Danish government during the Napoleonic Wars. This led to inflation which resulted in the Statsbankerot (State bankruptcy) of 1813. The Speciesbank shares were converted into bonds which circulated from 1813 to 1824. The Nationalbank was responsible for interest on these bonds

The Rigsbank, later renamed the Nationalbank, was founded in 1813 to restore monetary stability to Denmark. Initially, the bank’s goal was to stabilize the monetary system. The bank withdrew banknotes from circulation to bring the banknotes back to par with silver coins. The bank achieved this goal in 1845. Initially, the Nationalbank issued 6.5% mortgage bonds which circulated between 1818 and 1830. In 1837, the Nationalbank issued shares, which quadrupled in price by 1845 when the monetary system stabilized.

Beginning in the 1830s, the bank also rediscounted bills and granted secured loans. Because it was the only bank in Denmark, there was strong demand for these loans. In the 1840s, several banks were established in Denmark and the bank began acting as a banker to these banks, though the Danish Financial Supervisory Authority regulated those banks. It wasn’t until the banking crisis of 1908 that the Danmarks Nationalbank had to fulfill its duty as a Lender of Last Resort. Denmark joined the Scandinavian Currency Union in 1875 along with Norway and Sweden. The bank became the sole banker for the government in 1914 and after World War I, the bank focused on maintaining a stable exchange rate. Under the Danmarks Nationalbank Act of 1936, existing shareholders were bought out and the Bank became a self-governing institution whose profits accrued to the government. The bank wound down all commercial banking activities in the 1950s. The bank is a member of the European System of Central Banks, though Denmark is exempt from having to adopt the Euro as its currency.

Figure 10. Danmarks Nationalbank and OMX Copenhagen All-Share Price Index, 1837 to 1935